Table of Contents

Federal Withholding Tables 2021 – Just like any other previous year, the newly adjusted 2021 Wage Bracket Method Tables Printable was launched by IRS to prepare for this year’s tax time of year. It includes many changes like the tax bracket changes and the tax rate yearly, along with the alternative to use a computational bridge. You can utilize the tables to determine the sum of your federal income tax.

Now, even though coping with the actually-altering employment tax rates could be perplexing to suit your needs, it really is still necessary. For those of you who aren’t acquainted with the federal income tax or interested in learning about the 2021 adjustments, then this write-up provides some beneficial insights.

What Is Federal Income Tax Withholding Tables?

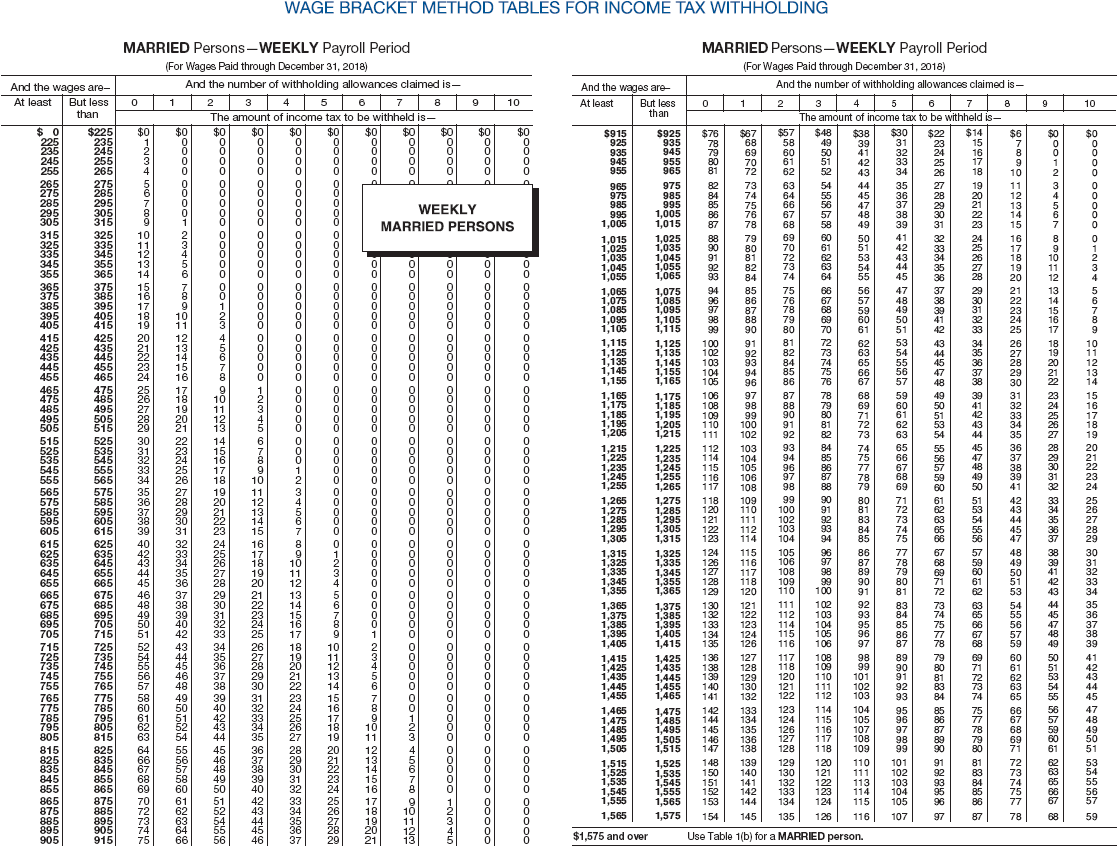

2021 Wage Bracket Method Tables Printable are definitely the established of information that helps employers to discover the amount of tax that should be withheld off their employees’ income. To make use of the table and find out the federal income tax withholding, the employers need to make use of the information from the W4 form, employees’ processing statuses, and the spend regularity.

How Can I Find Federal Income Tax Withholding Tables?

The methods to discover the employees’ 2021 Wage Bracket Method Tables Printable are described inside the IRS-released document referred to as Publication 15-T. In this particular document, you ‘d be able to find the step-by-step method to determine withholding by two methods: wage bracket and percentage strategies, which will be discussed additional within the next area. This record also includes the newest version of 5 worksheets with each of their appropriate federal withholding tables 2021.

Federal Income Tax Withholding Methods

As mentioned in before, you can find two methods inside Publication 15-T to determine federal income tax withholding. Learn about Federal Income Tax Withholding Methods below.

Wage Bracket Technique

When using the wage bracket technique, first discover which range that this employee’s salary are grouped in. Together with the details that’s inputted in the W4 form like standard or adjusted withholding, it will be possible to discover the withheld quantity.

Percentage Technique

The percentage technique might seem similar to the wage bracket, but there are a few distinctions. There is certainly continue to a kitchen table which has employees’ wages ranges, but it needs to be combined with percentage calculations and flat dollar quantity.

How the Federal Income Tax Works

Federal income tax will be the term that refers to the tax subtracted from income– which include all kinds of gained cash including wage, salary, tips, incentives, bonus deals, gambling money, to joblessness compensation.

The tax system inside the United States works with a progressive level. It means you must spend a higher tax percentage the greater cash that you simply generate. In 2021, there are seven percentage classes of tax charges that improves slowly, begins at 10%, 12%, 22%, 24%, 32%, 35%, to 37%.

Differences Among State Income Tax And Federal Income Tax

The income taxes that are applied from the state government and federal government are different. The rules of income tax and the charges involving the federal government and most of the states may differ a whole lot. For example, the federal income tax has a progressive characteristic, while some states apply flat tax rates for all ranges of income and some states use a progressive system as well.

Federal income tax is an obligation for all individuals required to pay taxes. Not all states require income tax payment. Some of the states that don’t collect this specific type of tax are Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. Other states such as Tennessee and New Hampshire only entail interest income and tax dividends instead of income tax. 2021 Wage Bracket Method Tables Printable

Federal Tax Withholding Table 2021 (Publication 15-T 2021) Printable

Loading...

Loading...

Circular E 2021 (Publication 15 2021) Printable

Loading...

Loading...

Related For 2021 Wage Bracket Method Tables Printable

[show-list showpost=5 category=”federal-withholding-tables” sort=sort]